Most of the chip market is in trouble, but ASML is fine

It took a little getting used to, ASML’s demure posture. After two years of orders pouring in and customers asking for expedited deliveries, this quarterly report was all about chip markets slowing down and orders being pushed out. Not so long ago, no chipmaker would even consider deferring delivery of ASML’s coveted lithography tools.

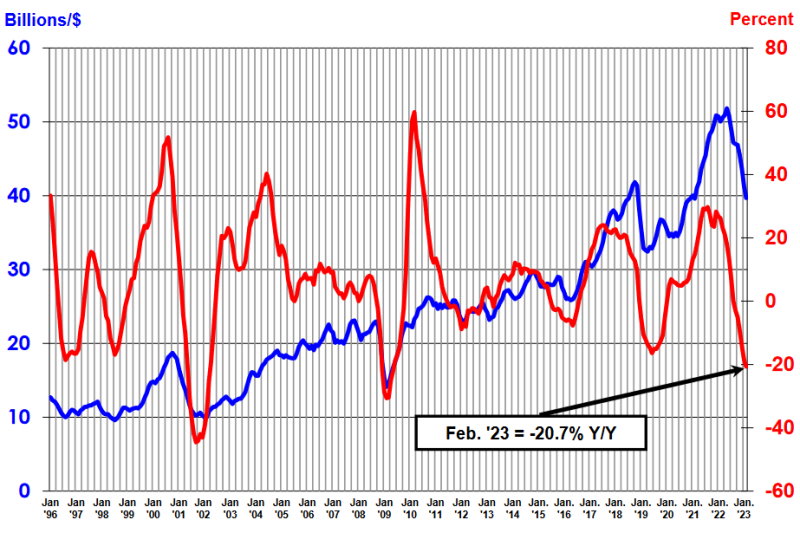

Two other industry bellwethers, TSMC and Samsung, didn’t have much better news on offer. The Taiwanese foundry is projecting its first annual revenue decline since 2009 and the Korean chaebol’s profits sank to an eight-year low as it reduced memory output. Earlier this month, the Semiconductor Industry Association (SIA) reported that February’s global semiconductor sales were down 20.7 percent year-on-year, following an 18.5 percent YoY decline in January.

Clearly, the industry has reached that part of the downturn where things start to hurt. As chipmakers scrambled to manufacture more chips in response to surging demand during the pandemic, they overshot the capacity actually needed. Absorbing that excess capacity will take time, especially since chip markets have cooled down in the interim – another feature of a classic downturn.

Led by PCs and smartphones, semiconductor demand began to soften as early as late summer last year. Automotive was one of few segments that didn’t seem to budge under the pressure of macroeconomic uncertainty stoked by inflation, but even car chip sales are now “showing signs of softening,” TSMC CEO CC Wei said.

Some worry that, following an unusually long and profitable upturn, the industry had been lulled into a false sense of security, resulting in a particularly bad slump. “Because the backlogs have gone up so much, they fear the drop is likely to be equally steep. It’s a bit nervous out there,” semiconductor analyst Amit Harchandani at Citi told the Financial Times.

Predictions from both ASML and TSMC that a recovery will pick up speed in the second half of the year don’t convince everyone. “One or two quarters more” before the uptick manifests itself, ASML CEO Peter Wennink told analysts. Wei forecast “a gradual recovery in the second half of 2023” for the industry at large, excluding memory. But Robert Maire of Semiconductor Advisors thinks that “hopes for a second-half recovery in 2023 will likely fade. The bigger question now becomes when/if in 2024 we’ll start to see a recovery.”

Future Horizons’ Malcolm Penn agrees. “The whole of 2023 is going to face strong headwinds,” he wrote in an industry note in February. Penn predicted the IC market would take a dive in 2023 as early as May last year.

Unscathed

ASML has become relatively immune to downturns over the past few years. Semiconductors have found their way into so much more applications now than ten years ago that things more or less evened out for the dominating supplier of lithography equipment. If there was a lull in one segment, business in another would pick up the slack.

While overall a comfortable position to be in, once in a while the semiconductor constellations might align in the worst possible way, precipitating a downturn that even ASML wouldn’t be able to escape. Could that be happening right now?

It doesn’t look that way. First of all, a backlog of 39 billion euros should take ASML to the other side of the downturn with only minor course changes, if any. Capacity in Veldhoven is booked solid well into 2024 and Wennink said he expected the orders to cover the remainder will come in the next quarters. Meanwhile, still anticipating solid long-term growth, ASML continues expanding its capacity.

Secondly, leading-edge chipmakers aren’t likely to cut tool orders and risk having to go to the end of the line. Having insufficient capacity available when orders finally start flowing in again may be more painful in the long run than having to confront investors with a few bad quarters now. Indeed, TSMC hasn’t cut capex and neither has Samsung. Intel is in a tough spot, but if it wants to have a chance of competing at the industry’s apex, it will have to invest, too.

Finally, business beyond the leading edge is still booming, particularly in China. “I think people underestimate how significant the demand in the mid-critical and the mature semiconductor space is. It will grow double-digit whether it’s automotive, whether it’s the energy transition, whether it’s just the entire industrial and products area, whether it’s the sensors that are an integral component of AI systems,” Wennink said.

Barring a deep global recession exacerbating an already bad situation, ASML seems destined to come away from this downturn unscathed.

Main picture credit: ASML