Your cart is currently empty!

Even a tech titan sometimes feels the weight of its crown

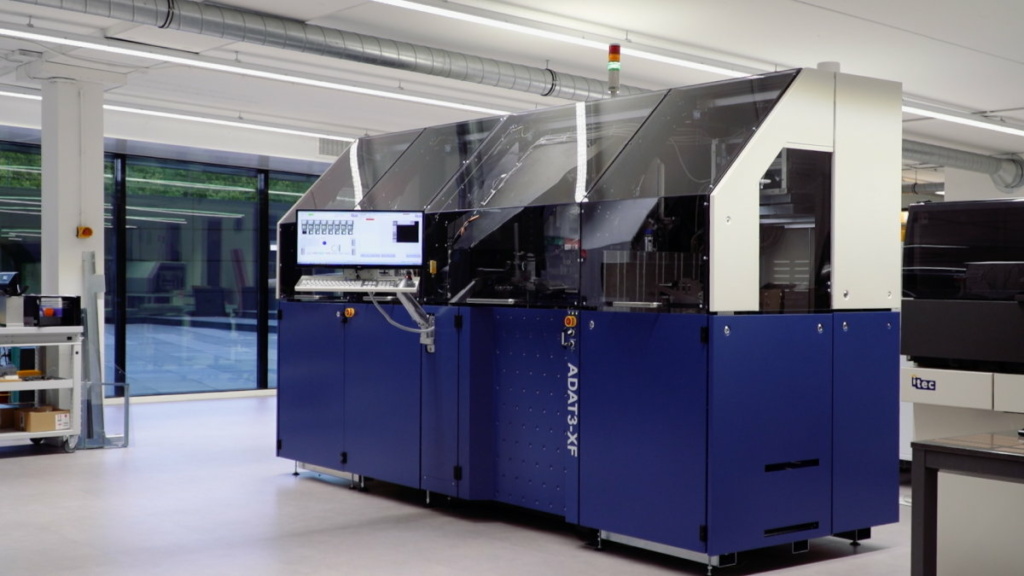

ASML finds its throne less comfortable these days. The king of chipmaking tools finds itself grappling with a changing semiconductor landscape, negative publicity on high-NA EUV and a prolonged downturn.

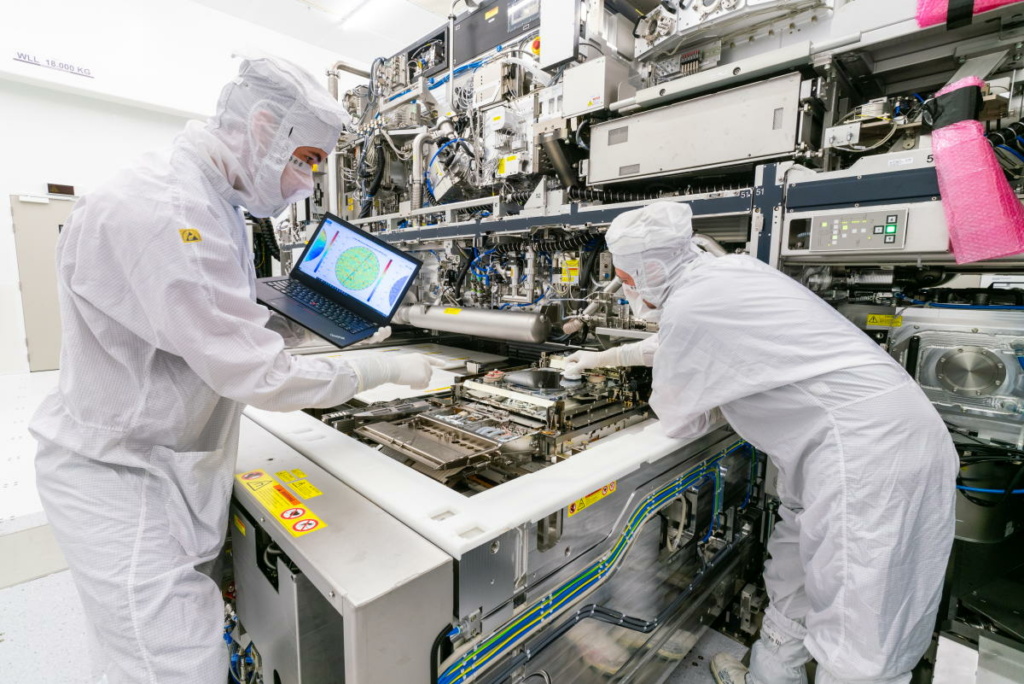

Dutch tech darling ASML enjoys one of the most enviable positions in the global technology landscape, cherishing a dominant market share and holding a monopoly in the patterning of the world’s most advanced semiconductors. Its machines with price tags of up to hundreds of millions of euros are extraordinarily complex, creating immense barriers to entry that insulate ASML from meaningful competition for years to come.

Despite this rock-solid base, sentiments about ASML have been tinged by pessimism lately. The firm has shed tens of billions of euros in market capitalization since July last year, while many tech shares soared amid the AI boom. Granted, the reference point – which saw ASML’s stock price briefly top 1000 euros for the first time – may be unfair, as investors probably got ahead of themselves about the short-term implications of AI adoption for the litho giant. Nonetheless, as macroeconomic and geopolitical factors have muddied the waters, even ASML itself would have to admit that it’s not where it thought it would be 1-1.5 years ago. Management isn’t sure that 2026 will bring reprieve, either.