ASML’s results are cause for optimism

ASML maintains a “conservative view” for 2024, but reading between the lines in management’s comments reveals cause for optimism that the upswing in the semiconductor industry may start well before year’s end. The Veldhoven-based equipment manufacturer itself is largely capacity-constrained, although there may be opportunities to deliver higher-than-guided sales in the EUV business.

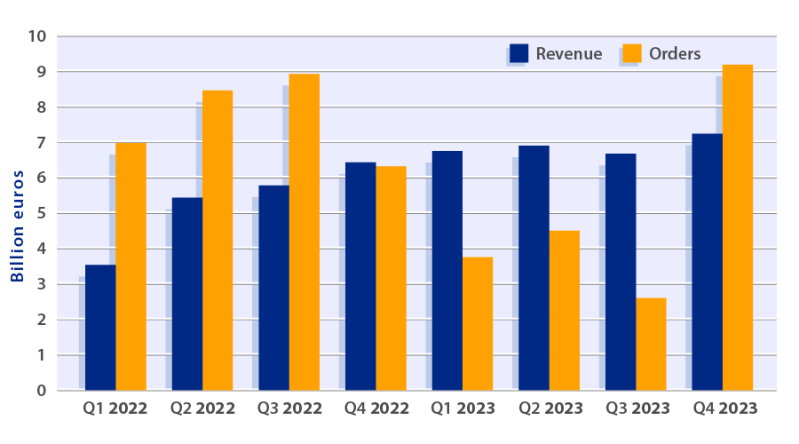

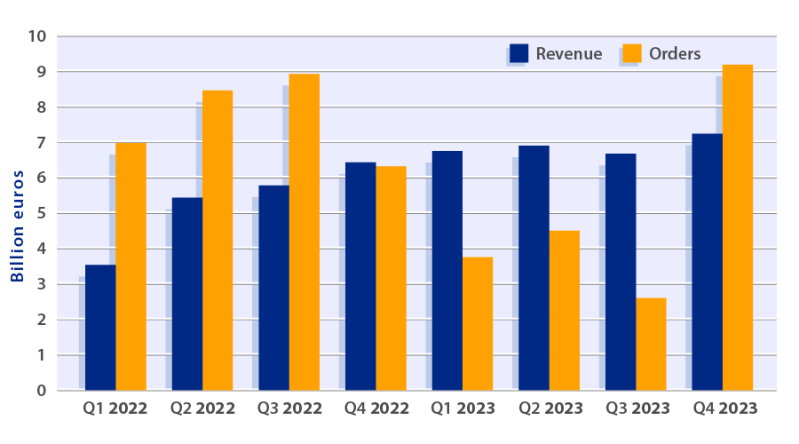

Officially, ASML designates 2024 as a “transition year” and “still believes it’s too early to revise our guidance” of flat revenue growth, despite “a few positive data points.” These bright spots are improving inventory levels in end markets, climbing utilization rates of ASML’s tools and, last but not least, a steep upswing in order intake – a record of 9.2 billion dollars in Q4 2023.

With history as a guide, ASML is expecting a steep ramp after the end of the downturn. This will be a big one, as the upturn coincides with a relatively large number of new fabs taking in tooling along with strong secular growth trends in the industry. As it stands, ASML errs on the side of caution when it comes to predicting when the industry starts firing on all cylinders, but when pressed on the matter, CFO Roger Dassen acknowledged that the slope of the ramp could be steeper, prompting customers to accelerate orders. “We look at 2024 and 2025 combined. And we know 2024 and 2025 will be two big years. It’s just a matter of: is it going to fall in one bucket or the other?”

For ASML, the timing of the upswing is of little consequence, as it will be churning out as many tools as it can – either for prompt shipment or in preparation for what’s to come. In DUV, ASML may be able to pull some shipments here and there, but it’s largely capacity-constrained. “For EUV, we may end up manufacturing inventory that we’ll need next year for sure,” Dassen said. “By default, we never take our foot off the accelerator.”

ASML recorded sales of 27.6 billion euros in 2023, up 30 percent year-on-year. Profits rose from 5.6 billion euros to 7.8 billion euros. According to Gartner’s latest estimate, the chip market slid 11 percent last year.