Your cart is currently empty!

Competition in automotive chips is mounting

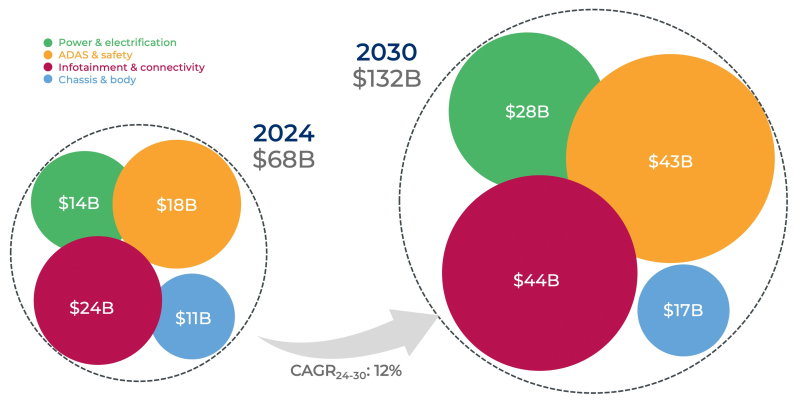

Even as the global automotive market grows at a modest ~2 percent CAGR between 2024 and 2030, automotive semiconductors are accelerating five times faster, according to Yole Group’s latest research. The three European semiconductor companies, Infineon, NXP and STMicroelectronics, stand to benefit from this growth, although the research group sees that challengers are multiplying.

Europe’s semiconductor companies have built scale and specialization and command nearly a third of the global automotive electronics market. However, they face growing pressure from both geographic rivals and vertically integrated OEMs. “The era of static automotive supply chains is over. Indeed, power, performance and geopolitical alignment are redrawing competitive boundaries while the gap between leaders and challengers is narrowing faster than ever,” says Pierrick Boulay, principal analyst Automotive Semiconductors at Yole Group.

Yole sees that US companies are bringing AI computing to the vehicle edge, while their future growth hinges on SoC penetration into ADAS, autonomous systems and cockpit compute. In Japan, semiconductor companies such as Renesas, Rohm and Denso remain strong in legacy MCUs and sensors. Finally, China’s 25-percent domestic content mandate by 2025 is already reshaping the automotive landscape. Chinese OEMs like BYD and Nio now design their own semiconductors, once considered a Tesla-exclusive advantage.

With every OEM becoming a tech company and every chip company chasing automotive growth, the competitive dynamics of this market have fundamentally changed. Technology differentiation, supply chain control and regional alignment now matter as much as device performance, Yole observes.