Your cart is currently empty!

Let’s not forget Itec in the Nexperia affair

The storm surrounding Nexperia has mostly been told as a story about chips and geopolitics. But in the shadow of that debate sits a smaller, quieter player: its subsidiary Itec. At this firm resides mechatronic know-how that’s just as strategic as semiconductors.

Now that the contours of the Nexperia affair are coming into focus, commentators are asking whether the Dutch government’s intervention was too heavy-handed. Minister of Economic Affairs Vincent Karremans justified the move by pointing to the chipmaker’s “crucial role” in Europe’s semiconductor ecosystem and its “significant economic security interest.” Yet, Beijing’s fierce – if predictable – retaliation has left parts of Nexperia’s production lines stalled, threatening not only the company’s stability but also Europe’s already fragile chip supply chain.

The affair once again illustrates how, since the pandemic, no one takes even the humblest chip for granted anymore. We’ve learned how a shortage of something smaller than a fingernail can paralyze the global car industry. It’s little wonder, then, that both Brussels and Washington have grown uneasy about China’s rapid ascent in this unglamorous but essential segment of the semiconductor market. Companies like Nexperia have become assets to be protected – sometimes zealously so. But in the rush to ‘save’ Nexperia for the West, something more subtle and potentially more vital risks being overlooked.

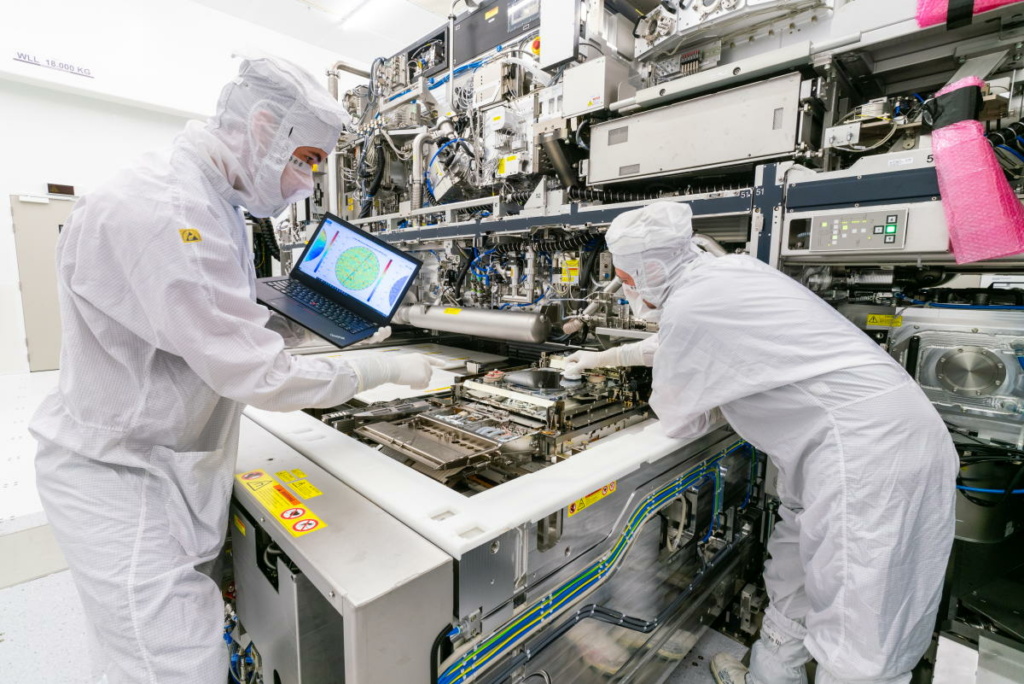

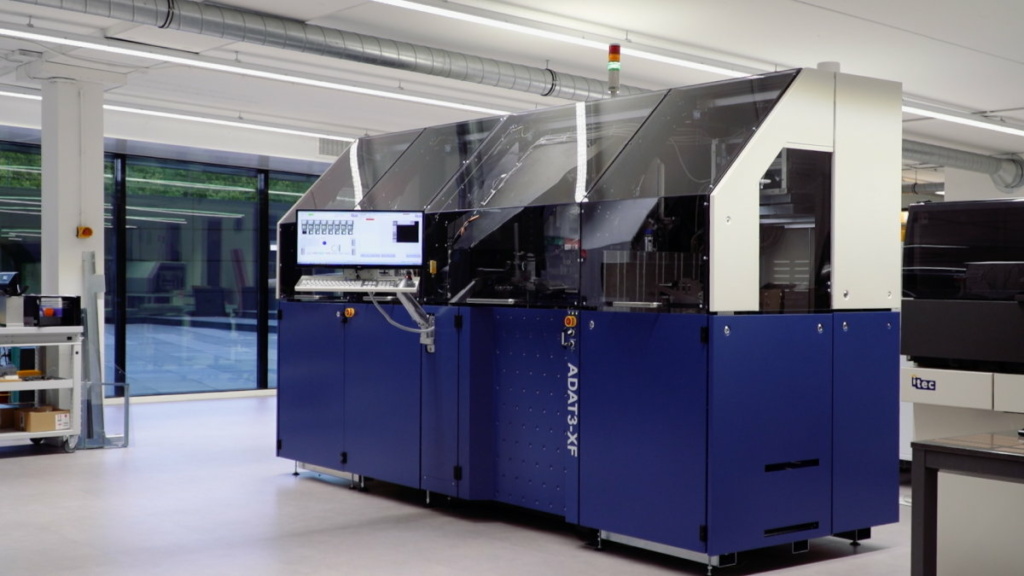

That something is Itec. Though formally spun out in 2021, it remains a Nexperia subsidiary – and a quiet powerhouse in Dutch high-tech. Its engineers have spent decades mastering the kind of high-precision motion systems that turn theory into tangible machines. Their specialty? Die bonders, those unsung heroes of chip assembly that pick chips off wafers and place them on substrates at breakneck speeds of tens of thousands per hour.

In one of its most advanced models, Itec has adapted a homegrown version of ASML’s famed Twinscan principle: two synchronized ‘windmill arms’ that work in perfect tandem to boost throughput. The resulting machine delivers up to four times faster throughput than anything the competition can offer.

This kind of mechatronic ingenuity has allowed Itec to thrive for decades in a market where every tenth of a cent counts. In the world of tiny components, back-end processes have traditionally determined most of the final cost. It should come as no surprise that foreign eyes are keenly fixed on this expertise, particularly as strategic fields such as advanced packaging and co-packaged optics come into view. With Washington restricting China’s access to cutting-edge lithography, the US is pouring investment into packaging technology as an alternative route toward next-generation systems.

It’s unclear whether any of that knowledge was ever at risk of ‘leaking’ to China, where, incidentally, Itec operates a plant. But one thing is beyond doubt: the Netherlands must protect not only its chip fabs but also its mastery of mechatronics and precision engineering. Nexperia may be the name in the headlines, but Itec embodies a much more strategic part of the Dutch high-tech ecosystem.

Fortunately, mechatronic expertise doesn’t live in patents. It lives in best practices, in open collaboration and in the collective memory of engineers who’ve spent decades perfecting their craft. That kind of knowledge doesn’t travel easily. You can’t simply ship it to Shenzhen in a crate.

Top image credit: Itec