Deep tech outperforms the broader Dutch tech scene in key metrics, while being less reliant on US capital, the State of Dutch Tech Report 2026 shows.

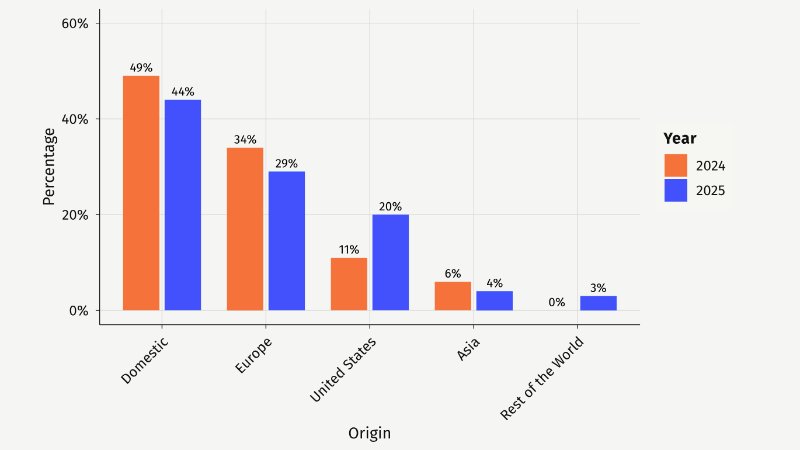

Nearly half of Dutch deep-tech investment in 2025 came from domestic investors, with most of the remainder sourced from European funds, leaving US capital playing a comparatively smaller role. That contrasts sharply with sectors like AI, where American money tends to dominate funding rounds. The diversified and locally anchored funding base gives Dutch deep tech a measure of strategic stability, according to the State of Dutch Report 2026.

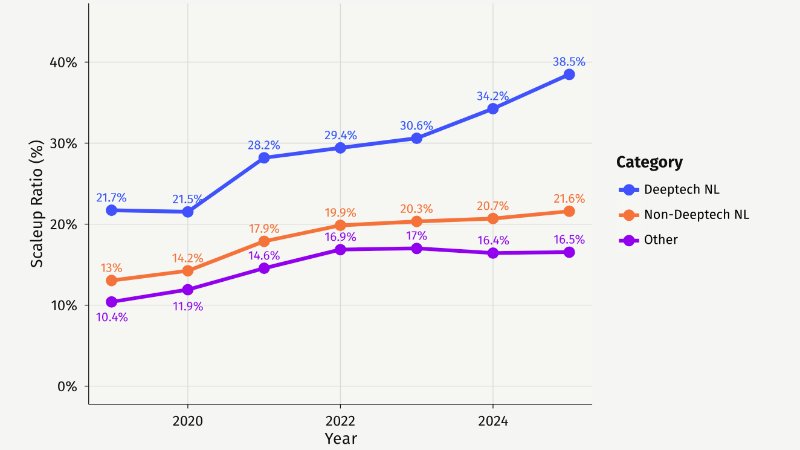

Deep tech represents 12 percent of Dutch tech companies, but punches above its weight in performance and capital capture. The sector accounts for roughly 40 percent of all Dutch scale-ups and attracts more than 40 percent of total venture capital investment. Its scale-up ratio stands at approximately 38-39 percent, more than double the 17 percent conversion rate seen in non-deep-tech sectors. In statistical modeling, deep-tech classification is the only company characteristic shown to independently predict faster scaling, even after controlling for AI status and market timing.

The deep-tech performance contrasts with the broader Dutch ecosystem, which is grappling with declining startup formation and a scale-up ratio that trails European peers. While general tech funding fell sharply during the post-2021 correction, deep-tech investment proved comparatively resilient, declining far less than the market average.

Investors appear to view science-based ventures, often grounded in proprietary IP and rigorous R&D, as more defensible and durable over the long term. Once technical risk is reduced, deep-tech companies benefit from barriers to replication that pure software startups rarely enjoy. That defensibility may help explain why the sector has maintained a two-to-one scaling advantage over the rest of Dutch tech since 2019.

Yet, there’s room for improvement in deep tech, too. Average deep-tech ticket sizes in the Netherlands remain significantly smaller than in Germany, France, Switzerland and especially the United States, forcing companies into more frequent fundraising cycles. Early-stage deep-tech funding has also declined since 2023, raising concerns about a future pipeline squeeze and a widening “valley of death” between seed and growth stages.

Unlike the broader ecosystem, where late-stage rounds have grown even as deal counts shrink, deep tech faces particular pressure because of its longer commercialization timelines and capital-intensive development cycles. Companies often require five to ten years of sustained financing before reaching market readiness, making capital continuity critical. Without larger domestic growth-stage vehicles, promising ventures risk either relocating or accepting constrained terms, the Dutch State of Tech Report 2026 warns.