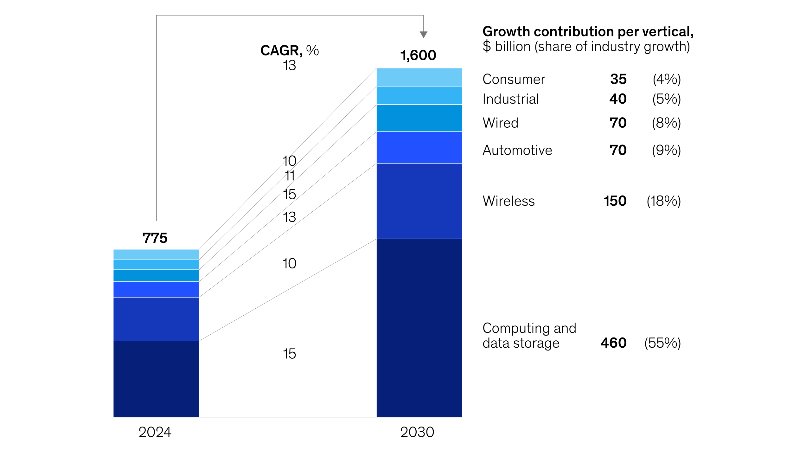

A broader accounting of semiconductor value, which includes in-house design and integrated-systems makers, could push the market’s true size from 1 trillion to 1.6 trillion dollars by 2030.

The semicon market might be much bigger than we think. According to a recent report by McKinsey, the total value of the global semiconductor industry could reach 1.6 trillion dollars by 2030. That’s not merely an update on the 1-trillion-dollar forecast issued by the consultancy a few years ago, however. It’s the result of a fundamentally different way of measuring the size of the market.

For years, the go-to metric for evaluating the semiconductor industry has been chip sales. Analysts have relied heavily on top-line revenue figures reported by semicon manufacturers. Based on that method, McKinsey estimated the market to be worth roughly 630-680 billion dollars in 2024, with the forecast pointing to 1 trillion dollars by the end of the decade.

But McKinsey argues that this traditional approach leaves a lot of economic activity out of the picture. Its new estimate of 1.6 trillion dollars is based on a broader definition of what actually constitutes the semiconductor market.

Rather than looking only at companies that sell chips directly, McKinsey’s model includes the full range of players involved in creating semiconductor value. That means not just foundries and fabless design houses, but also systems makers with in-house chip design, captive chip teams inside hyperscalers and integrated OEMs whose semiconductor operations usually don’t get priced into market totals. Prime examples of such companies include Apple, Amazon and Tesla.

By accounting for this broader set of contributors, McKinsey estimated the market to be worth 775 billion dollars in 2024, or about 20 percent higher than traditional estimates. The new 2030 assessment flows from a mid-range growth scenario that assumes strong, steady demand for advanced semiconductors. McKinsey’s low-end scenario, which factors in potential slowdowns or supply bottlenecks, lands at around 1.1 trillion dollars.

Most of the previously ‘left-out value’ is related to AI accelerators and data processing, which depend on leading-edge logic and high-end memory. Connectivity is another segment that could be bigger than previously accounted for. Legacy nodes and commodity segments aren’t affected as much by the revision.